This is Part 1 of a series on Hong Kong property developers, a group of companies worth >HK$1tn that many have called a ‘generational opportunity’ in my DMs. It’s definitely one of the cheapest sectors anywhere but there’s important nuance between value traps and compelling investments. There will be follow-up deep dives on the names I find most interesting, either for an attractive risk/reward or because it’s important to understanding the sector as a whole. If there is a specific name you’d like me to prioritise, leave a comment or DM me.

Pop quiz: What do ‘Wharf Holdings’, ‘Hong Kong Ferry’, ‘ChinaChem’ and ‘Mass Transit Railways’ have in common?

That’s right, they’re all real estate developers. Despite a significant fall in prices, Hong Kong’s property market remains by far the most expensive in the world, with residential property costing 18.8 times the median income. On the flip side, it’s also been the greatest wealth generator for Hong Kong based companies. Companies that bought property decades ago, whether as dockyards, ferry piers, power plants or factories saw that value skyrocket and overtake the original business in importance.

There are a few themes I think are particularly interesting for stockpicking:

Companies have different asset exposures to the following three geographies: mainland China; Hong Kong and RoW (mostly UK/US). Each of these have very different risk profiles and real estate pricing trends have been very different over the past few years (basically ordered in terms of worst to best); but names viewed in the ‘HK real estate developer’ bucket largely trade together. This creates opportunities for names with outsized exposure to RoW and minimal exposure to China/HK, despite being headquartered in HK or trading on SEHK - for instance CK Assets ($1113.HK) and Great Eagle Holdings ($41.HK).

REITs that are run by professional management, have a contractul obligation to pay out cashflow, and trade at a large premium (9+% dividend yield) to the risk-free rate make for good bond proxies.

Quite a few microcaps property bought decades ago which is ‘hidden’ at depreceated cost, often worth multiples of the company on its own. The most common outcome here is they form JVs with large developers that redevelop these assets; then take some profit share. Some will sell the finished properties and issue huge special dividends; some will hold onto them for investment and slowly pay out 5-10%/year. Some will end up being privatised at a criminally low valuation; some will give back to shareholders. In general I think it’s hard to pick any names out of these; and a basket approach is best here. Think of it as buying land at a fraction of its market value; and if you pick the ones with better corporate governance you clip a coupon of 7-10%/year while you wait for value to be realised.

All of these share a common thread: you don’t actually need the Hong Kong real estate market to do that well. That being said, any primer on Hong Kong real estate developers wouldn’t be complete with an overview of the Hong Kong real estate market.

Hong Kong Real Estate Market Overview

We’ll go deeper into most of these trends in specific writeups where they’re the key drivers of the stock, but at a high level the market’s history developed like so:

The Crown didn’t want to support the finances of colonies (or their largest expense, garrisons). The colonial HK government felt

under the treaty they received Hong Kong under, the government owned all land in Hong Kong, and the original Chinese residents were squatters on Crown Land1

income taxes ‘required an element of understanding as to why they were needed on the part of the individuals subject to said taxes and this understanding was usually widely lacking’2

Indirect taxation by selling the land the government owned was the best solution.

The practice has continued to the present day. As Econ 101 taught us, a monopoly restricts supply to maximise profits, and as a result, Hong Kong has become the most unaffordable housing market in the world while retaining extremely low income taxes (and no dividend/capital gains/VAT).

Data going further back isn’t great, but from the 1970s to the present day real estate has compounded at 7-10%. Cap rates compressed from a more normal 5-10% to, in some cases, <2% by 2021 for ultraluxury residential and CBD commercial.

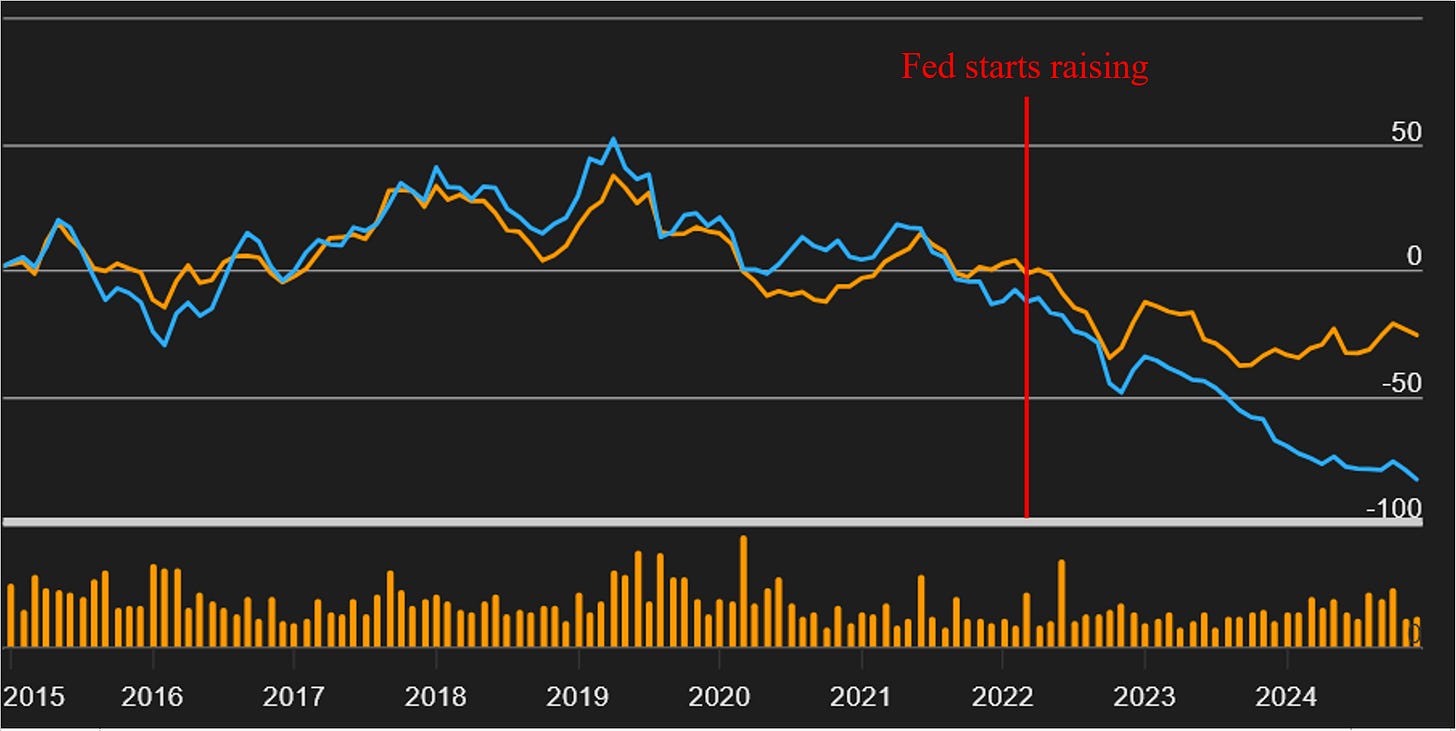

The bubble peaked in late 2021, and started an uncontrollable slide in early 2022 when the Fed started raising rates. Prices are currently ~25/30% below their peak.

Rent has actually been going back up; while prices continue to slide. The government has been running a significant deficit since 2019, mainly due to sluggish land sales. They don’t want to sell land at low prices; and developers don’t want to buy at above-market prices. The deficit for FY2024 is expected to be ~3.3% of GDP, which has prompted calls for reforming the entire tax system.

What’s next for Hong Kong?

Hong Kong has had a tough go of it the last few years to say the least.

From protests in 2019, to National Security Laws, Covid-19 and a protracted lockdown, sentiment is at an all-time low. Newspaper headlines claiming Hong Kong is dead come out every month.

These headlines all invariably point to Hong Kong being ‘just another Chinese city’ - the government is pushing a ‘Greater Bay Area’ concept where HK, Macau, Shenzhen and Guangdong are a unified mega-metropolis; transport links to the mainland are improving with high-speed rail; hundreds of thousands of emigrees fleeing after a national security crackdown being replaced by Mandarin-speaking immigrants and so on. The argument goes that as just another Chinese city, there’s no reason for Hong Kong real estate to command a premium to, say, Shenzhen just across the border. If taxation is reformed to be more normal (i.e. income-based), Hong Kong real estate values would also crater.

On the flip side, the government says (less crudely than I’m putting it) the raison d’etre of the city is unchanged - to act as a loophole for Chinese capital controls. As long as China needs to trade with the world and retain a fixed currency, this is something no mainland city can do; and Hong Kong real estate will command a sizeable premium from all the liquidity flowing through the city both going into businesses onshore and capital flight. At the same time, China needs Hong Kong to be a free trade port, and free trade ports generally have low income taxes. If HK is to remain competitive with cities like Singapore, the land-based indirect tax method can’t really be reformed.

In my opinion, the real direction things are going is that the border is being removed in practice, but retained nominally - but this isn’t a narrative that suits either side of the political spectrum. The government’s actions suggest they want to have their cake and eat it too- trialling frictionless, facial recognition-based border crossings where you walk straight through without stopping for identification/fingerprinting; while continuing to prevent capital flight. This has important implications for the different real estate sectors and sub-regions of Hong Kong which we will touch upon in the relevant deep dives. The short version is I think returns between different segments wil diverge much more greatly than before.

How does development in Hong Kong work?

As you might expect, development involves acquiring the land, actually building the property then selling it. There are a few market-specific nuances.

Land acquisition

The HK government gets most of its revenue from auctioning plots of land and deliberately restricts supply to maximise their revenue. As a result, acquiring land for development is extremely extremely expensive, taking up to 75% of the total project investment - 3x more ‘normal’ markets.

An alternative route is to acquire land on market. If you acquire a property that has been strata-titled (apartment block sold off to individuals) you need 80% ownership before being able to go to a compulsory auction to acquire the rest. This method is typically cheapest but takes up to a decade. Finally, you can acquire entire properties. There are lots of companies that own aging buildings, but can’t afford to redevelop themselves. The most common route here is a JV where the original owner retains some of the upside, brings the real estate and the larger real estate developer brings the capital + expertise to the table. Outright property acquisitions are rarer and typically happen when the original owner is distressed.

You can estimate the developed value of properties by looking at nearby comps from the Midland Realty ($1200.HK) website.

Properties that are held for investment are required to be held at fair value, with the address/size disclosed in footnotes. Properties that are held for operational purposes can be depreciated and specific disclosure is not mandated in annual reports. I’d suggest checking both the IPO prospectus where operational properties need to be listed; and announcements of property acquisition throughout the years. It’s a lot of legwork but on microcaps you can often find hidden assets worth multiples of the market cap this way.

Planning

Land in Hong Kong is all owned by the government and leased for 75 years. With a few exceptions for extremely old leases from the early days of the colonial government, leases come with restrictions on plot area; use and height limitations. If you want to redevelop an industrial building into residential, or increase the square footage beyond the plot ratio maximum, you have to pay a premium to the government to receive planning permission. You can check the allowed use and any restrictions on the Town Planning Board website. The difference in value between a plot with planning permission for residential/retail developments and one without is huge, often 2/3 times.

Building

If developing to sell, developers will pre-sell units with a 10% downpayment, typically up to 2 years in advance of completion (or ~1 year after planning permission is approved if they move quick). Developers offer a multitude of purchase options. The two key variations are where you start paying your mortgage immediately on presale; or where you start paying your mortgage when you move in for a slight price bump. The percentage of people that choose each variation changes depending on the discounts offered, but the key is that by the time of the presale, the developers typically turn cashflow positive. So on a cash basis, there’s a bigger outflow than in other jurisdictions during land acquisition; then cashflow turns positive within 2 years, twice as quick as markets without presales.

Historically, developers are able to achieve 20-30% cash IRRs when developing for sale. Accounting IRRs look a bit lower as HKFRS requires expenses to be capitalised and recognised along with revenue when the keys are handed over - the same treatment as non-presold properties in other jurisdictions. In other jurisdictions where presale is allowed, revenue + cost is typically recognised on a percentage of completion basis from the presale date to handover date.

When the government approves rezoning for a land premium, they typically calculate the required premium by looking at current market prices; subtracting expected development expenses, and allowing a ‘normal’ profit margin of ~15% IRR for the developer. Hong Kong real estate has appreciated at ~7-10% annually from the 1950s to today, meaning in normal times you get 20-30% IRRs. Some developers assumed this appreciation would continue indefinitely and bake it into their modelling. Other more conservative developers couldn’t compete and pulled back from development.

Interestingly, after the real estate popped in late 2021, land bought in 2020/2021 has been slowly coming up for sale and the projects are just about breaking even now. Some developers (often the ones that assumed prices would only go up) are gambling on the market by sitting on completed properties.

The situation is quite different if you look at developing to hold for investment. Here, you obviously don’t get to recycle cash so quickly. On the cost side, land acquisition costs are anchored by the potential profits from selling; and cap rates are so low in Hong Kong that it means it can take decades to get your money back in rent, let alone make a profit. You basically have to underwrite an extremely low cost of capital alongside decades of continued price appreciation for the numbers to work.

If you’re cynical, developing to hold for investment is value destructive, foolish, irrational and often ego-driven. If you’re more positive, holding properties for investment can give you stable, guaranteed cashflows through times of stress. These developers will never go through a 2008-style US homebuilder blowup. Even if the normally high ROIC development business starts losing money, you can tough it through the trough and have enough cash coming out the other side to recover quickly, making it particularly attractive to family-owned businesses that plan for generations rather than just their 5-year stock options. Personally, I lean more towards the former, though I can see the argument for the latter as well. Ultimately, it’s something that you probably need to determine on a company-by-company basis. The easiest way to do this is to look at their actual developments.

Empire building

An example of what’s not so good would be Henderson Land (HK:12), who always lacked property in the CBD of Central, buying a plot of land at auction for US$3bn in 2017, redeveloping it into a flagship eponymous 190m-tall office building ‘THE HENDERSON’. Including build cost, it’s likely that they’re getting a <2.5% gross rental yield on the investment - hardly what you would call rational value maximisation. A year afterwards, in 2018, CK Hutchinson (HK:0001) who lost in the auction announced they were redeveloping an existing 23 storey office next door to build CK Centre II, an office building 8 meters taller than the Henderson and positioned to perfectly block its prime harbour view. The building is finished, but a pitiful 10% of GFA has been leased. Again, shockingly petty behaviour that incinerated billions in shareholder value.

Many other developers like to construct fiefdoms, clusters of properties in an area all owned by one developer. For example, if you take the tube from the CBD in Central, you’ll find clusters of retail and office space >1m sqft in size at every stop - owned by Hong Kong Land in Central; Swire in Admiralty; Hopewell in Wanchai; Hysan in Causeway Bay. Developers point to network effects to proximity - an ability to curate ‘vibes’ to increase rent across the cluster; more efficient management costs etc. but they often pay extremely high prices to secure any properties that come up for sale in their clusters - or more cynically, they pay whatever price is necessary to make sure nobody encroaches on their kingdom.

The return on property development for investment is low enough as it is, without adding an extra 30-40% on top of the market land acquisition price to secure the empire.

At the company level, the tickers we’re looking at can vary wildly in every aspect but there are a few common themes:

Family-controlled: 80% in our universe are family controlled. They are typically now run by the second or third generation of the founder, to varying degrees of competence. The biggest risk to these names is that there’s little you can do to remove the family even if they’re utterly incompetent.

A follow-on point to this is corporate governance can be shockingly bad. The local regulator SFC is toothless and I’d even go as far as calling some transactions daylight robbery to line the families pockets at the expense of minorities. We’ll look at some examples of these transactions and how to avoid these pitfalls.

Conservative Leverage: The size-adjusted average gearing of these developers is 31.1%, significantly below global or mainland Chinese peers.

Significant Investment Portfolios: Perhaps as a result of the long history of the Hong Kong property market only going up, most of these hold investment portfolios alongside properties developed for sale; but they’re unlikely to sell (again, the Hong Kong property market has historically only gone up) and monetise for a quick gain.

Significant discount to NAV: The median trades at a 65% discount to NAV, mostly from the investment properties held at fair value which the market doesn’t think will be realised. For instance, HongKong Land, which has the highest quality commercial/office portfolio in the world, owning half of Hong Kong’s CBD, trades at a 75% discount to NAV. Great Eagle Holdings, which owns everything from the Langham hotel chain to shopping malls and residential developments in great locations, trumpets the fact they trade at an 88% discount to NAV in their investor presentation.

High dividends: Yields close to 10% aren’t uncommon. Due to the HK tax system where dividends are tax-free and income is taxed at 15%, most of these companies - especially the family-run ones pay small salaries to directors and supplement with big dividends.

With a high-level understanding of the industry, let’s look a brief look at each company in the sector. I put them into 3 main categories: Large, family controlled conglomerates; professionally run; and microcap ‘hidden asset’ names.

*I include the market cap, dividend yield and book value for each stock for easy comparison. Book value in particular is often off due to subsidiary consolidation; discretion in property fair values etc. so refer to them as starting points.

Family controlled

CK Assets ($1113.HK)

Market cap:HK$111b Div yield:6.4% P/B:0.2xCK Assets was spun off from CK Hutchinson ($0001.HK) in 2015 to hold the property assets. Their revenues are globally diversified, with broadly 1/3rd from Hong Kong, 1/3rd from the UK, 10% from mainland China and a quarter from the rest of the world.

Hong Kong revenues are a mix of property development and investment. Mainland China is mostly property development. UK/RoW is mostly utilities like power andwater; with some recent acquisitions like Civitas social housing and Greene King pubs. Most of the annual ~15b HKD underlying profit (excludes noncash investment property revaluations) in the past 2 years is from recurring utility/investment properties. Historically during a property upcycle, they can more than double that by layering on high-ROIC HK property developments; so they’re trading at 7x trailing trough earnings and 4x normalised earnings.

Trades at a 75% discount to NAV. It’s conservatively run with ~5% gearing and sensible operations, there haven’t been any egregious expropriations of shareholder value; and the heavy UK/RoW exposure is attractive. 75% discount to NAV//7x pe is about average for HK property stocks, but way under market for UK utility assets.

They even return ~10%/year through dividends (6.5%) and buybacks (3.5%). The main issue if you’re looking for one is that they’ve been acquiring assets rather than really hammering those buybacks. The company spent £4.6bn on 2700 Greene King pubs in 2019; and £485m on UK social housing REIT Civitas in 2023. Combined, they spent almost half of CKA’s current market cap on these two acquisitions; but they contributed just 1.3% of TTM profits. The acquisitions weren’t even overpriced, HK stock valuations are just that much lower. Management talks about M&A discipline and targeting double digit returns which is great, but even if they can achieve that the ROI on capital returns is just much much greater.

Pyramids and Pagodas released a great writeup on CK Assets at the same time I was writing this series of posts:

Full writeup will be released on the 27th of January.

Hysan Development ($0014.HK)

Market cap:HK$12b Div yield:13% P/B:0.18xConcentrated exposure to prime HK retail and office space held for investment, occasional immaterial development. 90% located in Causeway Bay. Retail is a traditional strong point catering to tenants like LVMH, Hermes etc. Investment in office has lifted profile of the area as a grade-A office destination in recent years but dynamics are shifting. Overpaid massively for a new development in 2021. Cheap if management is to be believed and they don’t commit to additional expansion.

Full writeup can be found below:

Wharf REIC ($1997.HK)

Market cap:HK$61b Div yield:6.4% P/B:0.33x Similar prime-area office/retail asset profile as Hysan, with a collection of smaller segments in hotels, mainland, singapore etc. (~10%). Assets are split between the tourist-heavy TST (70%) and Causeway Bay with a more even tourist-local split(20%).

I prefer Hysan though for the cleaner corporate structure and asset quality. Hysan’s controlling family has only 1 listed vehicle; while Wharf has a second listco ($0004.HK) and a third recently privatised. Hysan has also recently completed a major renovation capex plan, while Wharf’s assets are a bit tired and likely need major spending soon.

New World Development ($0017.HK)

Market cap:HK$13b Div yield:3.8% P/B:0.07xHenderson ($0012.HK)

Market cap:HK$115b Div yield:7.5% P/B:0.36xI want to discuss these two together because they’re a great case study for highlighting one of the pitfalls of investing in family-controlled conglomerates.

Before the peak of the real estate bubble in 2022, the two companies acted very similarly - next-generation heirs had recently taken the reins, and wanted to prove themselves with aggressive, debt-fuelled >HK$100bn expansions. Both had exposure to HK; the mainland; and a mix between investment and development properties. When the bubble popped on the Fed’s rate cycle, their fortunes diverged.

After trading roughly in line for most of the past decade, Henderson is down 25% from that day and New World is down 83%, almost entirely down to how they responded to that debt.

The retired patriarch of the Lee family who owns Henderson chose to loan >HK$60b to the company at below-market rates; unsecured and with no defined repayment terms. The retired patriarch of the Cheng family who owns New World fired his son (and 2 months later, his successor); has been selling off noncore assets at fire sale prices; and recently, they’ve even violated covenants on the debt. The HK Monetary Authority has called emergency meetings with lenders, calling on them to continue extending credit. It all sounds more like a mainland developer than a HK based one, but there’s a critical difference.

They have plenty of cash. That’s right, they could easily do the same thing as Henderson and bail the company out after overleveraging it with negative IRR pet projects. The family is typically viewed as having the majority of their wealth in the privately-held parent company, Chow Tai Fook Enterprises. Some other family conglomerates have sizeable business holdings outside the listed companies as well; but the Cheng family have a much higher percentage private than typical. They’re also much more willing to do related party transactions between the public and private companies, both M&A and ongoing transactions. For instance, Rosewood Hotels, a private subsidiary of parentco, rents most of its real estate from New World at rather low prices.

There is little incentive for New World Development to do well. If anything, the family is incentivised to make New World do badly so they have an excuse to strip assets out of it at distressed prices.

The key lesson here I think is to align yourself with the majority owners. Looking at decades of corporate history is more important than with other companies. Treatment of minority shareholders is something passed on from one generation of the family to another, so a spotty history is problematic. When in doubt, be cynical and assume the worst. In general, you want to look for companies where it’s either the only listed company (best); or it’s the top operating company in the corporate structure. Venturing into subsidiaries can have higher returns but also comes with higher risk, as below.

HongKong Land ($H78.SI)

Market cap:HK$76b Div yield:5% P/B:0.32xOwns an incredible portfolio of assets - half of Central, the CBD of Hong Kong. The only real estate company that comes anywhere close in concentrated quality is Mitsubishi Estates which owns most of Marounochi, Tokyo. They’ve been cleaning up operationally recently, exiting mainland China real estate development and doing buybacks. Trades at 1/3rd NAV.

The issue, again, is corporate governance. In the 1980s, HKL’s parent Jardine Matheson created a complex cross-holding structure to fend off activist investors. In 2021, they had another restructuring to simplify the corporate structure, where Jardine Matheson would acquire Jardine Strategic for $33/share, ‘a premium of 40% to the 6-month VWAP’, emphasising:

The Acquisition must be approved by a majority of at least 75 per cent of the votes cast by Jardine Strategic Shareholders. Jardine Matheson [is] entitled to vote [the] 84.89 per cent. of the existing issued share capital of Jardine Strategic held by Jardine Matheson […] in favour […]. Hence the requisite Jardine Strategic Shareholders’ approval is certain to be secured.

Jardines also emphasised:

As a number of the directors of Jardine Strategic are also directors of Jardine Matheson, the board of Jardine Strategic has delegated responsibility for considering the Acquisition to a committee of directors, comprising of those Jardine Strategic Directors who are not also directors of Jardine Matheson (the “Jardine Strategic Transaction Committee”).

They did not highlight how the two directors on the committee were both longtime Jardines employees who were on the board of other Jardines group companies, or how in the annual results released 3 days after the acquisition ‘offer’, market-value based NAV/share was pegged at $58.22, meaning shareholders were forcibly taken out at a 43% discount. All the listcos trade at a discount to NAV. The underlying NAV/share discount is closer to 75%.

Sometimes, these NAV discounts exist for a very good reason.

Sino Land ($0083.HK)

Market cap:HK$71b Div yield:7.4% P/B:0.41xHas a huge $46b net cash pile (65% of market cap) and sizeable 60% discount to NAV. Makes ~$3bn in recurring rental income from a HK portfolio; spread widely across residential, retail, commercial, industrial and car parks. Position of the investment portfolio is broadly middle-class and likely to be more severely affected by the northbound travel trend (see full writeup on Fortune REIT) than others. The development side is very lumpy, ranging from $0 to $15+b in revenue, averaging ~$3b historically.

Management doesn’t seem interested in returning their excess cash so the return of the stock will depend on how they spend their cash pile.

Hang Lung Group($0010.HK)

Market cap:HK$14b Div yield:8.2% P/B:0.15xHang Lung Properties ($0101.HK)

Market cap:HK$29b Div yield:12.7% P/B:0.22xThere are two listcos in the Hang Lung conglomerate. Hang Lung Group owns 63.65% of Hang Lung Properties and a small collection of assets; but trades at a 25% discount to just its HLP stake.

DaBao on twitter (give him a follow) once said to me “This Ronnie Chan guy writes great letters, why is his business such a disaster”; and I think that encapsulates the business perfectly. The company is communicative with investors; and treats minority investors well (at least, not differently than the controlling shareholders), but has consistently missed the mark operationally.

Of all the large HK developers, Hang Lung has invested the most into China, focusing on premium retail developments under a ‘66’ brand in Tier 1 and 2 cities. They’ve plowed basically all the cashflow from HK investment properties from the 80s/90s, and very occasional developments for sale into these luxury malls; but with a mediocre ROI. Mainland investment properties makes up ~2/3rds of revenue, and HK investment properties the remainder.

The company trades at ~5x its recurring rental income; but like many other developers the risk is probably that they continue plowing FCF into mainland expansion at mediocre ROIs - which is exactly what they’ve communicated. The choice between the two depends on your personal r/r preferences - HLG is obviously cheaper but yields 5% less than HLP; the relative upside will likely depend on whether steps are actively taken to remedy the discount.

His son has recently taken over as chairman, and I guess we’ll see if he’s better at walking the walk. I do recommend reading Ronnie’s letters though.

Swire Properties($1972.HK)

Market cap:HK$90b Div yield:6.8% P/B:0.32xPart of the Swire Pacific ($0019.HK) Coke-bottling/Cathay Pacific Airways conglomerate. Makes ~$HK8bn in recurring rental profit, 40% comes from HK office; 20% from HK retail, and 40% from mainland retail. Luxury retail/ A-grade office positioning. They have a few property developments coming up but it’s fairly expensive in comparison to all the other stocks we’ve covered.

The company is well-run. The 6th-generation Swire patriarch stepped down in 2021 to let a professional CEO run the business, and the improvement in capital allocation and operations has been dramatic.

Sun Hung Kai Properties($0016.HK)

Market cap:HK$213b Div yield:5.1% P/B:0.35xSimilar to Swire, I think SHK is well run, but expensive. Makes ~HK$18bn in recurring rental profit, 75% from HK and 25% from the mainland. Much broader exposure to different sectors from retail, office, residential, industrial to more niche sectors like datacenters. Assets range from the literal highest rent building in HK to lower-middle class malls, and all over HK, so would work well as a proxy for HK if you don’t have an opinion on segment shifts.

Has a significant land bank for development, though like many developers they’ve been pulling back on development in the past 2 years.

Professionally run

A second group are professionally run property investors/developers, typically REITs. These typically trade at a smaller discount to NAV (or even a premium) and receive more institutional interest as the REIT structure prevents cash hoarding and there aren’t as many related party transactions.

SF REIT ($2191.HK)

Market cap:HK$2521m Div yield:9.5% P/B:0.61xLogistics REIT, subsidiary of China’s leading 3PL SF Express. Market cap more than covered by valuation of the core HK warehouse. Provides excellent value as a bond proxy.

Full writeup below:

Fortune REIT ($778.HK)

Market cap:HK$8.3b Div yield:9.4% P/B:0.3xREIT that holds a collection of malls. Decently run, very attractive yield but in my opinion a value trap, and a perfect representation of a subsector that will underperform due to macro.

Full writeup can be found below:

ESR ($1821.HK)

Market cap:HK$50b Div yield:2.1% P/B:0.92xAPAC real-estate focused private equity firm. Fortune REIT above is among the assets they manage; but the business itself doesn’t matter too much. There’s a binding takeover offer from December 2024 at $13/sh; with the current stock price at $11.96 (8% arb). I don’t think it’ll get blocked, so it might be interesting if you think the deal will get wrapped up quickly.

MTR ($66.HK)

Market cap:HK$169b Div yield:4.8% P/B:0.94xHong Kong’s railway system, privatised in 2000. They make most of their profits developing properties directly above their stations, selling residential and retaining commercial. It’s a great business model - there’s very clear unique value add by creating transport links themselves. Michael Fritzell has done a writeup on the company (paywall):

Link ($823.HK)

Market cap:HK$85b Div yield:6.3% P/B:0.5xLink is another government-privatised REIT. Their core assets are shopping malls in low-income public housing estates. They’ve been facing significant pressure in recent months from a trend of HK locals going to Shenzhen for cheaper shopping, dining and even groceries. Compared to other companies on this list, they have a lot more exposure to the northern part of Hong Kong, which is physically closer to the mainland/easier to get north.

Smaller ones that arent nominally property investors but have 80+% of value in property, or subsidiaries of the big holdcos etc.

This group are typically even cheaper than the large developers - many of them are net nets; and the corporate governance is even worse. Personally, I’d either buy a basket of the very cheapest, or only buy ones with clear short term catalysts on the horizon.

Playmates Holdings ($635.HK)

Market cap:HK$1.18b Div yield:5.3% P/B:0.22x70% owned by the Chan family. US$150m MC. Main assets are a US$55m stake in Playmates Toys ($869.HK), a popular value pitch trading at ~2.5x (cyclical peak, trailing) earnings; and investment properties valued at US$600m. There’s currently a 7.6% trailing dividend yield but this should inflect upwards as they’ve been aggressively paying down debt in 22/23 from US$100m in FY21 to currently US$24m.

Full writeup can be found below:

Transport International ($0062.HK)

Market cap:HK$4.2b Div yield:9.7% P/B:0.26x44% owned by SHK ($0016.HK). They operate a bus business that generates $50m in normalised profits; and own fully depreceated bus depots worth billions in market value hidden on the balance sheet. They are continually redeveloping these in partnership with SHK. They also own 14% of Octopus, a highly profitable transport card payment system that generates US$100m profit per year.

Full writeup can be found below:

China Motor Bus ($0026.HK)

Market cap:HK$2.3b Div yield:6.1% P/B:0.33xDespite the name, doesn’t actually have anything to do with buses. Cash and property box worth 4x current market cap. Well-regarded activist investors have been involved for years already with some success. There’s a plot of land currently being developed with Swire ($1972.HK), expected to complete in 2025/2026 which could act as a catalyst. Biggest risk is that they keep the cash.

Full writeup can be found below:

Asia Standard ($129.HK)

Market cap:HK$525m Div yield:N/A P/B:0.03xSTAY AWAY. The company is nominally a property investor/developer and trades as a net-net, but they managed the incredibly impressive feat earlier this year of losing HK$5.8b gambling on Evergrande bonds, more than the combined revenue from development/investment over the past decade. The controlling family clearly view the stock as a personal gambling pot with utter disregard for minority shareholders.

Hong Kong Ferry ($0050.HK)

Market cap:HK$1.5b Div yield:5.9% P/B:0.21xBull case courtesy of @RecoveryTrade on Twitter:

Worth noting they don’t have any real ‘hidden’ fully depreceated properties on their balance sheet; management has random pet projects like beauty salons that burn a little bit of money every year. 33% owned by Henderson but they don’t work together much.

Get Nice Holdings ($0064.HK)

Market cap:HK$1.2b Div yield:7.9% P/B:0.21xOwns a HK$1.66bn stake in Get Nice Financial ($1469.HK) - a small stockbroker, as well as properties held at $1.1bn . P/B discount is overstated due to $1469 consolidation. Half of the properties are in London and half in HK, but the company doesn’t actually disclose what exactly they own. The cap rates are ludicrously low at <2%. I’d guess they’re probably worth closer to $250,$300m.

66% owned by founder. The company has previously issued stock at what seems to me an extremely low price; and then done tenders at 30% of NAV, so corporate governance isn’t great. The juice doesn’t seem worth the squeeze with this one.

Wing On ($0064.HK)

Market cap:HK$3.4b Div yield:9.2% P/B:0.19xChain of failing, unprofitable department stores. 3.4bn cash, 1.9bn securities investments, no debt. Investment properties valued at 14bn. Most of these are office and retail space above the department stores. 14bn is aggressively valued on ~300-350m NOI. I think a fairer valuation for investment properties is ~6bn, + ~3bn for the 309,000 sqft currently used for department stores (not held as investment properties at fair value but rather at ~$0). So total NAV is $14.3bn.

I like the dividend policy of paying out 50% of underlying profit (ex noncash property revaluations). I don’t like the neverending attempts to make the department store model work with spending on renovations, product refreshes etc. They recently closed the last leased department store which is as clear a sign as you can get that without the ‘subsidised rent’ from owning the properties the department store model simply doesn’t work in 2024. They’d be far better off just leasing that space out but the board which is stacked with members of the controlling Kwok family doesn’t seem interested in that. Overall it doesn’t seem like an awful company, just take the department store as a minor drag on a property biz throwing off cash.

Conclusion

If you’ve sat through all that, congrats!

You probably noticed that the vibe is a lot more negative than most investment pitches. That’s for two reasons.

As I mentioned, the corporate governance can be terrible, and I think coming into investments in HK with a cynical mindset of ‘how will I get screwed here’ is the best way to avoid this pitfall.

At the same time, the bull case is usually very, very clear and doesn’t need elaboration - the stocks are just so ridiculously cheap that if you don’t get screwed by management, it’s hard to see how it could go wrong.

My advice to everyone considering HK is to be aware of the market-level differences versus an exchange like the NYSE - be a cynical c*nt!

NOT INVESTMENT ADVICE

This content is for informational purposes only. You should not construe any information as legal, investment, financial or other advice. Do your own due diligence.

Report from the Hong Kong Land Commission of 1886-1887

Paul Reinsch, Colonial Administration, pub. 1905

Amazing primer/write-up! Far East Consortium ($0035.hk) is a personal favorite of mine with lots of development assets out of HK (Australia and UK) as well, but a high gearing and a recent dividend cut.

Don’t you think that Swire is probably the highest quality counter on this entire list which justifies the valuation that it trades at.

Their assets in both the mainland and Hong Kong are very high quality with stellar occupancy rates. Only their newer properties have occupancy rates below 90% and most of their occupancy rates especially for their offices and shopping are above 95%. Some of their high quality retail assets even have 100% occupancy

Their gearing is one of the lowest in this list at only 13%, their recurring profits only fell 8% in H1 24 and they managed to increase their dividend even in the toughest macro situation that both Hong Kong and China have faced in the last 25 years.

They have an investment plan of HK$100 billion and they’re branching outside to SE Asia and the U.S. as well.

At a 7% dividend yield and 0.32x times book with professional management very very conservative gearing and a dividend which wasn’t cut even in this macro environment I think it’s the safest buy here