Fortune REIT ($778.HK) is a retail REIT backed by CK Assets ($1113.HK), Hong Kong’s largest conglomerate (with CK Hutchinson $0001.HK). The REIT yields a tad over 10%, owns defensively positioned malls and trades at a historically high 72% discount to NAV. Despite what the numbers would have you think, the HK retail real estate market faces very real challenges, and Fortune isn’t necessarily a compelling opportunity.

Business Overview

Cheung Kong is a major real estate developer in HK. The typical large-scale development has thousands of units around a central mall which contains all your daily necessities and transport links to the rest of the city. CKH typically sells the residential apartments but retains the retail mall underneath for investment.

In 2003, they spun off these malls into Fortune REIT. Over the next twenty years Fortune consistently acquired more malls, mostly from CKH, getting to 17 malls (16 in HK, 1 in Singapore) today. The stock trades at a >10% dividend yield and 70% discount to NAV. If you’ve read my introductory post on HK real estate stocks, you’ll know that this is a very high discount for a REIT which are viewed as better run. Fortune has historically traded between a 30-40% discount to NAV, nudging 50% during the GFC.

So what’s the issue? In one word, Shenzhen.

Shenzhen

Tables should be as cramped as possible; and seats as uncomfortable as you can make them so customers get the hell out after they finished eating. The straws need to be wide; and the ice cubes come in XL. If they finish their drink in a single sip they’ll buy another.

That’s a satirical quote from the Stephen Chow movie God of Food, and it really just encapsulates how to make money in HK F&B. Rent and labour costs are so high that customer experience suffers.

Meanwhile just across the border, Shenzhen has rapidly developed, with GDP passing HK in 2018 (GDP/capita is still about half). Land is plentiful and labour is cheap, and as a result the experience for low/middle-class dining; shopping and recreation is more enjoyable. Luxury shopping (like Hysan) is less affected.

When combined with efforts from authorities on both sides to reduce the friction of crossing - building a controversial high-speed rail; contactless border crossings using just your phone (no identity documents or fingerprint scanning required); and now even removing the need for your phone where you can walk straight through; its become extremely popular for HK residents, particularly low - middle class residents who live in the New Territories (closer to the border) to go to Shenzhen for weekend day trips. It’s been described as a ‘retail apocalyspse’; with restaurant owners owners calling it worse than Covid.

The map above shows Fortunes malls, with the size being the relative income contribution and the number being the time it takes to get to the border by public transport (add 15-20 minutes onto this number to get across the border, double that on holidays). The malls are mostly located in the New Territories to the north of HK, and the largest 3 (>50% of revenue) are within an hour of the mainland. The proximity to the mainland and middle-class nature of the housing estates these assets sit under means Fortune is overindexed to this trend.

Footfall is trending 10% below 2018, the last year before protests and Covid. Actual spend is trending even lower at >20% below 2018 levels; as on a daily basis footfall Mon-Fri is completely recovered and down 20%+ on weekends where discretionary spend is concentrated from everyone heading to Shenzhen.

What next?

I don’t think this trend is going anywhere. The government is incentivised to support this trend of outbound consumption to bring HK culturally closer to the mainland after the 2019 protests; and if retailers suffer in the process so be it.

There are some factors which should reverse - e.g. there’s a degree of post-Covid lockdown revenge travel going on, but I don’t think these will be enough to stop the trend.

Instead, the only way out is rent cuts. We have already seen this.

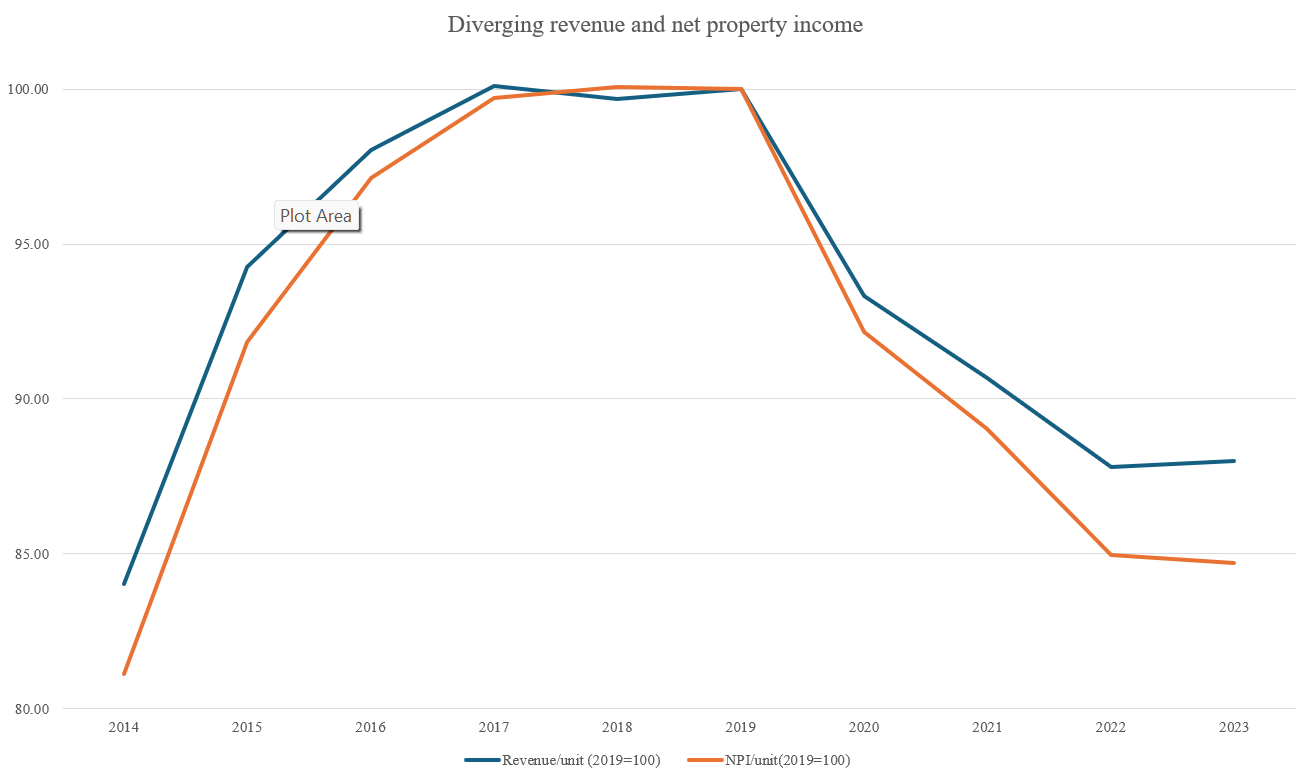

Fortune (and many others) basically fake their rental reversion numbers by setting a strong headline rental rate; but then giving long rent-free periods or renovation subsidies hidden in marketing opex that should really be included in revenue. You can better see this trend in how revenue and net property income are diverging.

In my view, rent in specific sectors (e.g. F&B) comprising ~50% of gross rental income need to come down a further 30% to be competitive with the mainland. Other segments like fashion retailers are actually price competitive with Shenzhen but suffering because of lower footfall; while banks, medical etc. are more insulated. The blended drop required is ~20%.

On top of that, middle-class neighbourhood malls in Hong Kong like Fortunes are typically highly monetised:

They operate with a high GLA/GFA ratio.

Typical anchor tenants are supermarkets, fashion retailers and cinemas; while across the border malls incorporate experiential anchor tenants like indoor skiing, theme parks, go karting etc. due to intense pressure from e-commerce drawing shopping demand online. In Hong Kong, malls have already begun incorporating similar unique experiential features like amusement parks, skate parks and art exhibitions.

Financially, on top of the sector-specific rate cuts, expect to see lower leaseable areas; mix shift to lower-rent/sqft sectors, and possibly an elevated capex cycle to rearchitect for these experiences, bringing the total potential impact to 30%.

This is significantly higher than what I expect to see from similar ‘neighbourhood malls’ further south. If you live on Hong Kong Island for example, it might take 2 hours one way to get to the mainland, and HKD$200 (US$25) in transport costs, making it less of an attractive alternative. Fortune used to have a mall like this, but they sold it a few years ago at an incredible 1.8% cap rate. More broadly, I expect all real estate in the north to underperform alternatives in the south, whether retail, residential or anything else. 10 years ago, when you cross the border from Shenzhen to Hong Kong, real estate would spike in value; whereas going forward I expect more of a gradient of prices from Shenzhen towards Hong Kong Island; with New Territories prices declining significantly while Shenzhen prices rise. As I mention in Part 1 of this series, the border being functionally gone means it will be seamless for Hong Kong residents to live in the mainland and commute across, arbitraging any cost differential.

Finally, the strong USD (and pegged HKD) means the SZ-HK cost differential is magnified. If macro is favourable and HKDCNY weakens to more historical levels, that could be 1/3rd of the 30%. Quite a few companies in real estate and broader retail have been pinning their hopes on this (chart below comes from Wharf REIC $1997), but I’m less confident. It could just as easily get stronger if China counters Trump tariffs by weaking the CNY.

Corporate Governance

The REIT is managed by ESR($1821.HK, an APAC real-estate asset manager). In Asia, it’s quite common that the strategic shareholder would also be paid to manage the REIT, which introduces an obvious conflict of interest you have to monitor carefully. ESR then outsources property management back to CK ‘at arms length’, which looks like it defeats the whole purpose of a 3rd party REIT manager; but in this case, professional external management is a positive. The property expense ratio is 2-3% lower than comps. However, there are still questionable corporate governance practices. Justin Chiu from CK Assets essentially spearheaded the spinoff in 2003 and was chairman until 2017 when he stepped down (he’s still a director). His daughter Justina joined the group in 2008 and became CEO in 2015. The nepotism isn’t great for what should be a professionally run stock but she’s done an acceptable job in my opinion. Headwinds have been out of her control and she’s adapted to bad macro.

Looking further back, the REIT has generally been well managed, leveraging up when rates are low to acquire properties accretive to NAV/unit / NPI/unit; and deleveraging with divestments when rates rise. Broadly, I’d say they got a good price on their larger properties in major housing developments; and slightly overpaid (by ~10%) for properties in small housing developments (think 10-20 small shops attached to a small, remote development. The only customers will be residents; with no chance of outsiders making shopping trips). Most recently, they sold a mediocre property at a crazy <2% cap rate in 2018.

The sole exception to this is in 2008/2009. They had a massive rights offering/acquisition spree in the depths of the GFC, when the stock was already beaten down. I’d add that the underlying fundamentals at the time were solid with (real) positive rental reversions and reasonable NAV estimates, far better than today; the stock was down 60% mostly on the whole ‘GFC real estate’ thing. The whole series of events was hugely destructive to shareholder value. I’m not entirely sure what the rationale was. They bought two properties from the parent Cheung Kong and one from MTR; if it was intended as a bailout of CK the MTR acquisition wouldn’t have been necessary, and it was hardly large enough to make a dent on CK’s financials. The properties were bought at a 3-5% cap rate, similar to their acquisitions

Using REITs as a vehicle to offload properties at inflated values is a common trick from many developers. Regal REIT ($1881.HK) is in my opinion the worst for this. Typically, the initial spinoff will be at fair prices (makes it easier to raise at IPO); but then the controlling-shareholder-cum-manager will make ‘arms length’ deals to continuously acquire dilutive, overpriced properties that always get ‘independently’ appraised as fair prices. Fortune/Cheung Kong isn’t the best, but they’re also far from the worst. This is a major risk with REITs you have to monitor, so go back 20, 30 years and look at every acquisition.

To conclude:

It’s yielding an attractive 9%; but faces strong macro headwinds. If you want professionally run REITs with a guarantee that they won’t hoard/siphon cash, SF REIT has a similar yield in a more defensively positioned industrial sector. If you want retail exposure, names like Hysan and Wharf are cheaper and in segments of the market that should outperform. If you specifically want Hong Kong REIT retail exposure, Link REIT is significantly more expensive but has a cleaner corporate governance track record. In my opinion, despite the yield, Fortune is only suitable if you have a very differentiated view on the Shenzhen travel trend.

NOT INVESTMENT ADVICE

This content is for informational purposes only. You should not construe any information as legal, investment, financial or other advice. Do your own due diligence.

Love this series, so useful. Thank you

Backed by ck asset holdings 1113 HK not CK Hutchison 1 HK