This is part of a series of posts on Hong Kong based property developers. For context on the sector as a whole, feel free to refer to Part 1.

History

The China Motor Bus ($0026.HK) company was started in 1923 by Ngan Shing-Kwan and ran a franchised bus service for years. If you want more context on how franchised buses work in Hong Kong, see the post on Transport International Holdings. Ngan was famously thrifty and believed people wouldn’t be willing to pay a premium for air-conditioned buses. Evidently, he was wrong, and by 1998 service had degraded so much the government stripped them of their franchise. Today, CMB is a cash and property box with an activist investor pushing for value realisation.

Ngan passed away in 2001 and the business is now run by his 3 children who have retained his penny-pinching habits - AGMs were held inside bus depots from when it was operational all the way through to the year it was falling apart from disuse and due for demolition!

The assets are fairly simple:

Cash - HK$1.3bn earning ~60m interest/year (0 liabilities)

Some of this is needed for capex on property development, but >1bn is excess

Property portfolio generating ~HK$100m NPI/year (more on this later)

CMB has been steadily disposing properties, most recently a UK property that generated ~HK$20m NPI in Sep 24 for ~HK$450m (a quarter of the market cap!) $100m is on a go-forward basis.

Most remaining properties are bus depots that they previously developed.

Looking at recent transactions for comparable properties, the carrying value is actually under market value.

A former bus depot being redeveloped into ‘Headland Residences’, a luxury 850-unit residential site. There are no remaining undeveloped sites.

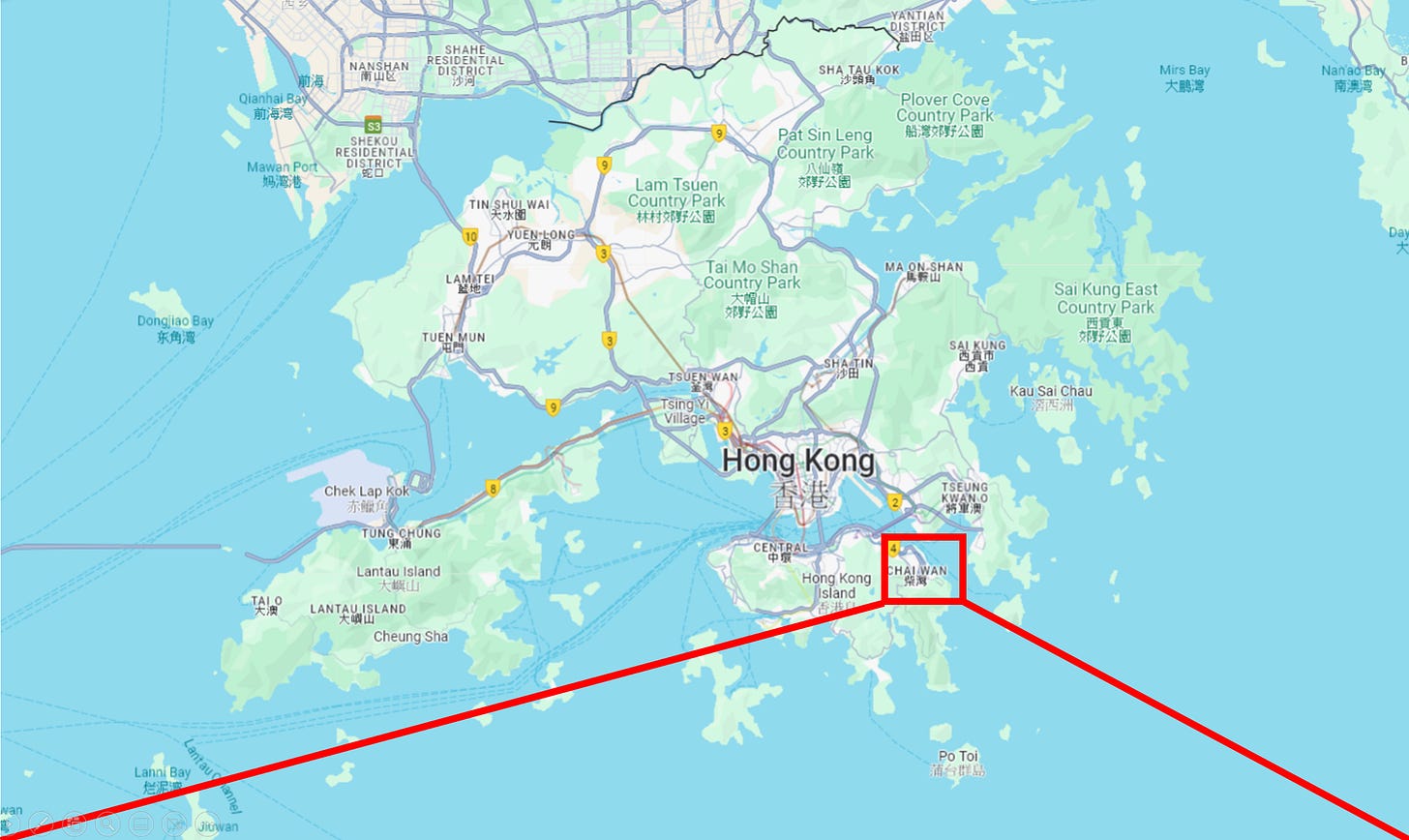

The plot is located in Chai Wan, a predominantly lower-middle class neighbourhood on the east of Hong Kong Island. You can see from the map above that it’s in between some light industrial plots (mostly more bus depots, auto service centers etc) and residential (a lot of public housing).

For a reminder of the development process and HK-specific quirks, you can review the primer. CMB sold 80% of the lot to Swire properties in 2015 at a HK$850m valuation. After years of negotiations with the government over land premium to convert the site into a 694k sqft residential and commercial development, they agreed on HK$4.54bn in 2021 (CMB’s share HK$908m), at basically the peak of the HK RE market.

Artists rendition

As of our site visit in December 2024, the buildings had been topped out but the facade was not completed. The company expects completion in 2025. Depending on market conditions they may choose to sell in 25 or wait until 2026/27.

The main comparable for Headland Residence is Island Resort, a 2001-vintage luxury development from Sino Land ($0083.HK). It’s quite old at this point but has better views so erring on the conservative side, I feel the range should be fairly close.

Recent transactions have been in the $14500-$15000/sqft range, down 25% from when CMB green lit the project and paid the land premium. As a result, the expected profits will be down significantly from what was expected (>HK$1bn); but they should still be able to make a small profit which is better than many developers in this market.

Note that due to the accounting structure for Headland Residence where CMB sold the property to an associate, they have already recognised ~650m in revaluation profit. The profit above will be what they report off this higher base when the PnL is recognised on delivery.

The bigger part of this is that there’s no excuse for management to hang on after this is finished. Liquidation is the most logical way forward. And of course, the accruals based profit where CMB recognises all the expenses on delivery is different to the cashflow (where >85% of the outflow has already been incurred) or the carrying value of the properties (basically the ~HK$2bn revenue).

Capital allocation:

There are plenty of dirt cheap HK property stocks, and 9 times out of 10 capital allocation is where it all falls apart (the remaining 1/10, the controlling shareholder tries to rob the minorities). CMB is interesting because it was previously woeful, but has been improving under activist pressure from Argyle Street Management (ASM) since 2017.

A key part of the investment is whether the profits from Headland Residence gets paid out as a special dividend. I think it’s worthwhile to include the company’s dividend policy in full here:

The company’s dividend policy is to pay regular dividends. In setting the company’s dividend policy, the board of directors of the company (the “Board”) recognises the need to strike a balance between paying regular cash dividends to shareholders and retaining sufficient cash to reinvest to grow the company's future profits, enabling the payment of higher dividends to shareholders in the future.

The Board targets to declare dividends broadly equivalent to the profits earned from recurring income (i.e. profits from rentals and finance income), after tax, during the year in question. When further profits are made from the sale of investment properties/ developments for sale, the Board will consider the payment of one off special dividends after taking into account the company's opportunities to earn future profits from reinvestment of such proceeds. Unrealised profits due to revaluation of investment properties (as these are of a non-cash nature) are not considered when setting dividends.

In general, this is a very good dividend policy for a HK company, most of whom have a vague ‘as the board sees appropriate’. The company has been slimming down its investment portfolio because of ASM, selling a property in FY2020 for HK$2.375b and paying out HK$1.92b in special dividends in excess of the typical dividend - half in 2019, not shown below. They’ve further sold a UK property in September 2024 (after FY24 end) for $450m with plans to distribute that too so it does look like they’re getting ready to shut down and distribute Headland once that’s sold.

The red flag is that the dividend policy isn’t really followed in the spirit of the policy. The company reports $120m in recurring profit on the income statement - half from finance income and half property income. But they exclude properties held through JVs/associates from these and bundle them together in the non-operating section of the income statement in a single line item after noncash revaluations. The company started disclosing the ~HK$60m underlying net property income attributable to CMB in 2021 (which is good), so in reality the payout is closer to 80% than in excess of 100% - less good. When you consider the cash position, there’s really no reason for that.

More broadly, while Argyle succeeded with forcing some asset disposals and special dividends, they failed with some of their other requests:

1) CMB has worked with Swire to develop all their properties, not just this latest one. ASM wanted a competitive bidding process for the plot but failed.

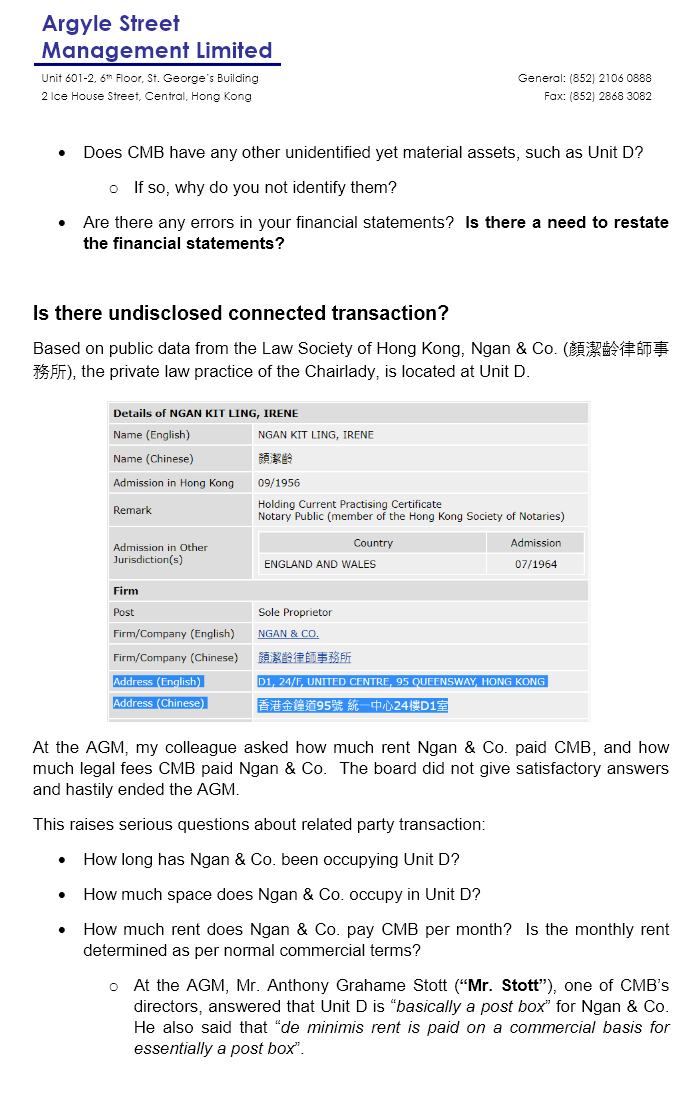

2) CMB owns an undisclosed office worth ~HK$50m rented to the former chairladys law firm. ASM weren’t successful in getting more disclosure around the property. As far as I can tell, the property hasnt been disposed of either, and is still making minimal rental income. It’s ~2.5% of the market cap/0.5% of liquidation value so not too material but its shoddy corporate governance. For more context, see the appendix.

Conclusion

So overall, when Headland Residence is finished, the SOTP is as below:

There’s a very, very healthy margin of safety. The bull case is complete liquidation, but even with the activist pressure I don’t think that’s the likeliest scenario. I think dividends in excess of the current market cap over the next 2 years are likely though.

NOT INVESTMENT ADVICE

This content is for informational purposes only. You should not construe any information as legal, investment, financial or other advice. Do your own due diligence.

Appendix:

Argyle Street Management’s activist campaign site can be found here, here and here. The letter from 2017 can be downloaded here. The site has been down for a few months so just in case, I’m also including the letter here:

Most insightful series, thank you!

Is it a coincidence that Argyl's website is down in the last months?

Great write-up and worth following up on the situation. What is worth mentioning too is that the stock went from about 120HK$ in 2017 (when Argyly stepped in) to about 50 HK$ today. Surely there have been a lot of dividends paid out in between, but do we have a Total Return view of the stock?