This is part of a series of posts on Hong Kong based property developers. For context on the sector as a whole, feel free to refer to Part 1.

10-second pitch ($635.HK)

US$150m market cap. Main assets are a US$55m stake in Playmates Toys ($869.HK), a popular value pitch trading at 2.6x (cyclical peak) earnings; and investment properties valued at US$600m. There’s currently a 7.6% trailing dividend yield but this should inflect upwards as they’ve been aggressively paying down debt in 22/23 from US$100m in FY21 to currently US$24m. There’s also a possibility of a near term catalyst in a privatisation offer.

Business Overview

Michael Fritzell (once again) has previously covered the company, though primarily looking at Toys.

Playmates Toys:

The keys points to note for Toys are:

Playmates was founded in 1966. Over the next few decades, it licensed a few well known brands and became one of the largest toy manufacturers in the world, chief among them Teenage Mutant Ninja Turtles which accounts for >90% of Playmates sales.

Revenue is fairly cyclical in line with TMNT movie/TV shows. 2024 saw a well received movie and revenue more than doubled. In dry years, the company is unprofitable.

There’s a big cash pile, 0 debt and the stock is a net net. (NCAV HK$~1.2bn, MCAP HK$750m). In the worst years they’ve lost <HK$100m cash, but given the cyclical nature of the business and previous management comments around safety nets I don’t expect the cash pile to be materially paid out.

Playmates lost long-held TMNT exclusivity to Moose Toys after Michael’s post, but Moose don’t seem to be pushing hard on the franchise. Here are the brands featured on their website:

Playmates Toys was spun off 2007, leaving Holdings with the current structure.

Playmates Toys is trading at 2.6x trailing NI. Forward earnings are certainly going to be lower, but as always with cyclical/faddish franchises it’s difficult to judge by how much:

Bearishly, Google search interest peaked around the movie release and has fallen back to normal levels.

Bullishly, 24 H1 saw YoY growth, even after interest had faded. I’d expected flat or declining YoY comps. Historically (8 years out of the last 10), H2 is stronger than H1 because of Christmas; and the movie was released in August, so the 23 H2/24 H1 decline is expected. I expect a further sequential decline in revenue in H2 24, but hopefully margins will be maintained to have bottom line land in the 30-50m range.

A sequel to the movie has also been confirmed for late 2026; as has a spinoff TV series, and Paramount is supposedly hoping it’ll kick off a whole cinematic universe (what a novel idea…). This whole universe is headed up by Seth Rogen, who’s probably the perfect fit for the job of churning out entertaining, cash gushing childrens movies. Seth has commented on an interview that he came on to produce TMNT because he fell in love with the toys as a child. It’s bringing Playmates full circle in a way, a kid they entertained 35 years ago is now making Playmates hundreds of millions.

Note: For a toy business I actually prefer Dream International ($1126.HK). Has previously been written up on ValueInvestorsClub and by GlobalStockPick. Short version is: pure manufacturer (no licenses/owned IP) for Disneyland, Funko Pops, Pop Mart and so on; with a diversified manufacturing base and manufacturing scale advantage. I think they’re operationally better than Playmates; and they’re less boom-and-bust than relying on a single franchise. 4.5x PE, 12% div.

Properties

The company owns a few properties, the main one being ‘The Toy House’, a 23-story commercial building in the popular shopping district Tsim Sha Tsui.

It’s on Canton Road, which is a really popular shopping street right next to the world-famous Star Ferry. The anchor tenant on the bottom 2 floors is an Apple store which saw a big negative rental reversion last year. NOI across the portfolio dropped ~25% from this one lease. Something that’s pretty unique to Hong Kong is that restaurants will lease upper floors in random commercial buildings. There’s absolutely 0 organic footfall compared to a street-level storefront or mall; but it’s significantly cheaper and if you have confidence in your food and ability to draw customers it’s a common way for restauranteurs to cut their biggest cost. I’ve touched on this a couple times across the series of writeups but these less prime assets in prime locations have been absolutely killed in the retail leasing market - tenants are moving to better assets like Wharf-owned Harbour City just across the road and paying the same rents that they were paying for Toy House a couple years ago; and there isn’t the same dynamic as in the office market where tenants in less prime areas are actively looking to upgrade. There are three empty floors that have been leasing for months now. The market value of this type has come down dramatically - ~50% from 2021, double the market decline. If the market recovers, they might see a bigger upswing too but as it stands today the market value of the property portfolio is significantly lower than book value because of the Toy House depreciating.

Useless iPhone trivia:

iPhones sold in different regions are actually slightly different!

- In the EU and Japan, there are software limitations on headphone volume.

- In Japan, there’s a camera shutter sound you can’t disable to prevent creeps.

- China, Hong Kong and Macau are the only regions in the world with dual physical sim slots - pretty much everywhere else is 1 physical + 1 eSim.

- The Chinese version can’t make audio or group Facetime calls.

These restrictions are generally tied to the hardware, meaning you can’t change them even if you move to a different country. As a result, there’s a surprisingly active grey market for Hong Kong version iPhones from Japanese customers; customers who want two sim card slots; and of course, customers in sanctioned countries like Russia.

In the early days of the iPhone, Hong Kong would get them on the first day, alongside the US, while China would get them months later, leadding to insane scalping - 2,3x premiums on list prices were common. You could queue up for a few hours, buy the maximum two iPhones, walk out the store and flip them to sellers, making a few hundred USD before all the brand new phones get shipped across the border to China. Link That’s gone now - China gets releases on the same day, but Hong Kong is still likely the region with the highest number of iPhones sold/capita.Aside from the Toy House, there’s a factory in Tuen Mun that’s a redevelopment opportunity. For an idea of what this might look like, you can check the China Motor Bus writeup. Finally, there are a couple of residential assets in Hong Kong and overseas.

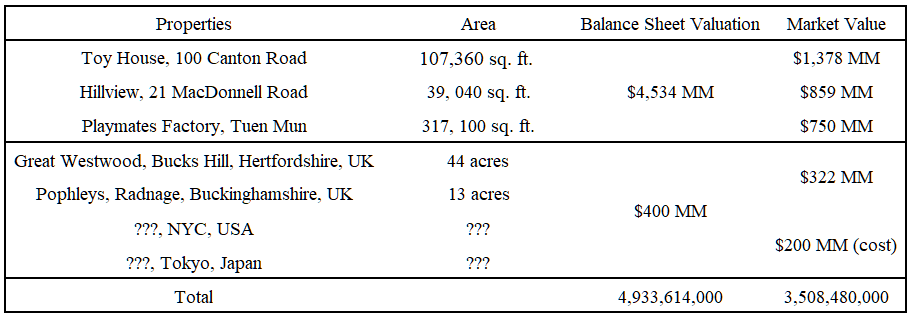

Disclosures around properties have gotten steadily worse over time. The company stopped disclosing how many square feet each property had in 2013; and in 2015, they even stopped disclosing the exact properties they owned overseas. There are two properties in NYC and Tokyo the company spent $25m USD on in 2015 which shareholders don’t even know the address of. There was also an odd line in the 2015 Annual Report -

“ We are also exploring leasing opportunities for our overseas residential properties.”

I don’t have any proof either way given the lack of disclosures but it does make me wonder if the overseas properties are actually being rented out for investment or if they’re holiday homes for the family. We do know the two UK properties above are still both owned by Playmates as the Land Registry hasn’t recorded any transactions. Management will probably disagree but personally, I don’t think owning a manor estate ‘favoured by Edward VIII’ is logical capital allocation for a Hong Kong based toy company.

Finally, they also have a small investment portfolio worth ~$US12m, owning things like $DIS, $AMZN, $NVDA, $AAPL, $MSFT, $NFLX, $GOOG, Tencent, and Sun Hung Kai, Wharf REIC. I’d obviously prefer they didn’t do this and just gave the cash to shareholders to invest themselves, but the disclosures are fairly transparent and the stocks aren’t shitcos (unlike someone like Asia Standard who went all in on Evergrande bonds). This isn’t thesis breaking.

Management and Ownership

Today both companies are run by three of the founders grandchildren:

Michael Chan (Chairman):Yale, ex Citi, KKR. 39 years old; Worked at Playmates since 2010, led US operations from 2017-2021, became chairman in 2021. 5.02% ownership

Helen Chan: Yale, Wharton MBA. ex consulting, luxury retailing. Worked at Playmates since 2014, runs the real estate and stock investments. 1.35% ownership

Stephen Chan: Cambridge, ex banking. Worked at Playmates since 2014. Runs ‘overseas investments’ - seems to be more of a ceremonial role than actual responsibilities. 0.13% ownership

Playmates Holdings is essentially a shell - they outsource property management, so all you do is receive rent and dividends from Toys. Each of the siblings gets paid ~US$300k/annum. Frankly this seems high, especially for Helen and Stephen. In 2023, director compensation was nearly half of Playmates Holdings opex.

Finally, their father Thomas Chan (retired, not on the board) owns 65.24% of Playmates Holdings. The total owned by the family is 71.74%, which is fairly close to the 75% free float limit. Historically, the family used decently sized buybacks but they’ve basically stopped and put more into dividends since getting close to the free float limit.

The vast majority of the family’s ownership is through Holdings. They own ~2.5% of Playmates Toys directly, but this is either through a Toys-level share option plan, or open market purchases after the family got close to the 75% ownership limit at Holdings. I think the family are fairly well incentivised to maximise value at both companies.

Risks

The primary risk (or catalyst, depending on how you view it) is privatisation at a large discount. It’s quite possible that this is a near-term issue. The company’s founder died in 2020 at home, and in October, the family sold his house for US$32.2m (float is currently ~US$43m). They get a fair bit of cash every year from the company’s dividends, so they shouldn’t be feeling any pressure to monetise the property down 30-50% from right after the founder’s death - unless, of course, they think they can get a higher IRR by, perhaps, buying out Playmates at a third of its real estate value.

In HK, you need 10% of float (or 2.83% of outstanding shares/ US$4.3m) to block a privatisation. You might think that retail shareholders wouldn’t accept a buyout that’s too cheap, but disappointingly time and time again I’ve seen privatisations go through at a fraction of NAV. Retail seems to be happy to take a mediocre 30% premium and get out, rather than fight for fair value. Typically you have better luck if a single institution or large holder like David Webb owns enough to block the transaction on their own. Nobody is above the ownership threshold for disclosure of 5%, so we can’t be sure if a >2.83% holder exists.

How much should it be worth?

To keep it simple, assume the actual toy business is worthless and assign liquidation value to the Toys stake. That should be worth $0.29/Holdings share.

The properties are held at US$600m/HK$4.9b/HK$2.4per share; market value is closer to US$450m/HK$3.5bn/HK$1.72 per share.

Debt of US$24m/HK$0.012 per share lands us at $2/share, with the stock trading between $0.5 and $0.6 over the past year.

It’s obviously cheap, but to be completely honest I’m not jumping at the opportunity. There are lots of similarly cheap companies in HK.

If you’re hoping for a liquidation/buyout, CMB seems a better bet than Playmates to me.

If you want the toys business, I like Dream International more.

If you want the dividend, 7.6%, or even >10% if they pay out more after the debt has been paid down isn’t extraordinary in HK.

Personally I’d view this more as a basket candidate than something to size.

NOT INVESTMENT ADVICE

This content is for informational purposes only. You should not construe any information as legal, investment, financial or other advice. Do your own due diligence.

I'd love to get on a call with Michael Chan to hear what his dreams and ambitions are. He seems intelligent.