Left Field Printing is a book printer led by proven capital allocators, with an unappreciated strategically advantaged position. The company is a subsidiary of Lion Rock Group (HKEX:1127), one of the largest book printers in the world.

Background:

For additional background on Lion Rock’s and Left Field’s history, you can read this VIC post from 2016 (1010 printing was renamed Lion Rock in 2017, while Opus was renamed Left Field and relisted to HKEX in 2018). The short version is this: Chairman of Lion Rock CK Lau has created tremendous value for decades, across a range of industries, flexibly using a range of tools (organic growth, cost cutting, M&A etc).

In the 8 years since the writeup, CK has compounded FCF/share at 14% (TSR has been disappointing at 8.9%, dragged down by wider HKEX woes), acquiring a publisher Quarto Group and being the first scaled printer to diversify manufacturing beyond China, in a prescient acquisition in light of geopolitical tensions. More pertinent for Left Field, they have consolidated 90% of the domestic Australian read-for-pleasure printing industry through a string of acquisitions, most recently the second-largest printer Griffin Press, in 2022.

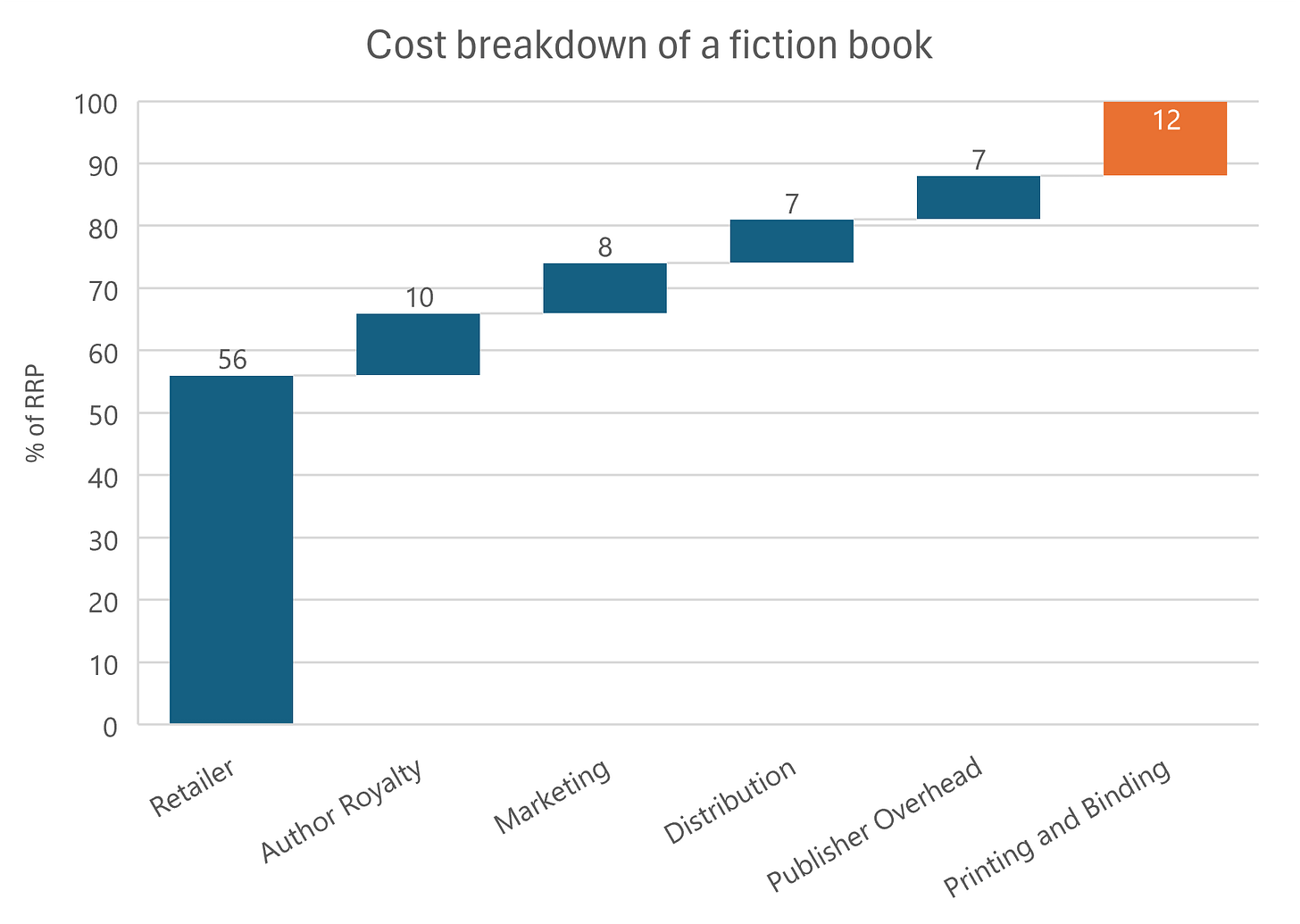

~A$1.3bn of printed books are sold in Australia per annum1 . 42% is non-fiction; fiction is 30% and childrens books are 28%. There’s no direct Australian data here but going off other markets, about 50% of childrens books and nonfiction are addressed by Left Field(monocolour). This results in ~A$850m in sell-through revenue, growing 1/2%/annum that Left Field addresses. Within this A$850m, COGS is ~12% of RRP, or ~A$100m.2 On the Left Field side, I estimate ~25% of revenue comes from the government and other noncore lines like textbooks, leaflets and operating manuals. In 2023, Left Field had HK$558m (A$108m) of revenue, so ~A$81m of revenue from read-for-pleasure. This implies of the A$100m attributable to read-for-pleasure printing every year in Australia, Left Field captures ~81%; competitors capture ~8% and imports capture ~10%. The numbers will vary depending on shipping costs; exports to markets like New Zealand etc. but Left Field absolutely dominates the segment of the market they compete in.

Investment Thesis

The immediate reaction of everyone when they hear ‘asset-heavy book printer in Australia’ is understandably to run for the hills. Industrial manufacturing in a dying industry, with 0 moat against foreign imports from companies like Lion Rock. However, there are a few underappreciated aspects that make the company interesting:

Cost:

As the VIC writeup mentions, Lion Rock generally makes ‘evergreen’ show piece books, with the benefit that they are generally more insulated from ebooks. However there is another facet that was not discussed. These glossy, colour books (4c printing in the industry) are more expensive to produce. As a result, the proportion of the cost that shipping it across the world takes up is smaller, which makes Chinese printers like 1010 more competitive. For ‘1c’ (black and white) printing, the cost is lower, which makes domestic printers -whether in Australia, the UK or the US more capable of competing. Australia’s isolated geographic position makes this effect even more pronounced. The landed cost is about equal between offshore and onshore.

Speed:

Within 1c printing, requirements for faster turnarounds means Left Field is stronger in fiction compared to manuals, journals and catalogues etc.

In recent years, the industry has been shifting from offset printing, where you manufacture a unique plate for each book, coat it in ink and press it onto paper, to digital printing, which is more similar to consumer-type printers. The upfront fixed investment for digital is much lower, driving a major change in publisher behaviour. With offset printing you’d make a large print order, on the scale of thousands/tens of thousands of copies to amortise the upfront cost of the plates. With digital, you can order much smaller quantities, lowering inventory risk and improving working capital efficiency, even though currently digital printing is still marginally more expensive than scaled (10k+ copies) offset per copy.Today, you typically see offset printing used for guaranteed winners (if Game of Throne’s Winds of Winter were ever to be released for example), while digital is favoured for the majority of lesser-known titles. The move to an asset-light inventory strategy from publishers means a rapid turnaround time is important in case of unexpected demand. Left Field can deliver on a scale of weeks, while it’d be months if you were to import.

Combined, this has resulted in a position where Lion Rock, through 1010, imports coffee table books into Australia, while Left Field, through its subsidiaries Opus; McPherson; and Griffin manufacture fiction books in Australia.

Acquisitions:

Historically, negotiating power has been in the hands of publishers. Shrinking demand has resulted in structural oversupply and vicious price wars between printers both in Australia and China. Every printer that has been acquired into Left Field over the past decade+ was unprofitable, before being turned around by CK and team. Excluding Covid, operating margins have fluctuated between 4-8.5%; but in reality, the down margin years coincide with acquisitions, and after turnarounds margins are historically stable at 7/8%.

Today, Left Field prints for Penguin Random House; Macmillan; Hachette and practically all other small/medium publishers. The remaining 10% of the market, HarperCollins, is printed by IVE(ASX:IGL), an integrated marketing firm with a strategy of cross-selling legacy printed media customers on digital marketing. Fiction printing is non-strategic and accounts for <5% of revenue. Left Field management seems bullish on acquiring HarperCollins when that contract expires soon, which I tend to agree with. After all this consolidation, for the first time since ebooks appeared, the pricing power lies with the printers (well, printer).

Left Field is absolutely aware of their newfound market position. Immediately after the Griffin Press merger, several smaller publishers complained that prices had been increased dramatically. I further believe that Left Field’s pricing power is not yet reflected in their financials, as they are still streamlining Griffin’s operations after acquisition. Lion rock’s printing turnarounds usually takes 2-4 years to complete, suggesting numbers should begin inflecting this year, through 2026.

Valuation

An attractive aspect of CK Lau’s companies is that they deliver shareholder value for minorities. Aside from large dividends, and his TSR record, they recently made a tender offer for 25% of the Quarto Group (LSE: QRT), offering a 25% premium, despite not technically needing to. This gives me confidence in underwriting a generous payout for Left Field. Currently there is a dividend payout ratio of ~60%, yielding 8.3%. I expect the payout ratio to be maintained or increased, as there is no more M&A on the horizon. This is a critical part of investing in HK companies as all too often investors never see the FCF generated by their company.

I model top line growth of 2% and operating margins of 8/9% going forward, reflecting the increased pricing power and lack of noisy acquisitions. I also model 100% FCF conversion, though historically it’s been closer to 120%. This base case is fairly conservative and gives a 63% margin of safety.

Risks

The largest risk is that CK Lau is 70, and while he seemingly has no intention of stepping away, he’s not in the best of health, having had a serious case of Covid in 2020. While Left Field, having consolidated the Australian industry already, is much easier to run than the global Lion Rock, losing the best operator in the industry would hurt any company.

Another risk is that ebooks dramatically accelerate in taking share. In my opinion, this is pretty unlikely due to the structure of the industry.

In the past few years, printed fiction demand has stabilised at ~60% of overall fiction demand and is growing at a CAGR of ~1/2%, excluding a Covid spike. It appears that at similar prices, most people still prefer the physicality of printed books, whether for the tactile experience or sense of ownership just seeing it on a shelf. A long-held concern that ebooks, with their 0 marginal cost of production would be sold much cheaper than physical books, also has not materialised. Since the onset of ebooks, publishers have not-so-quietly colluded to maintain the prices of ebooks. For more background, you can read this blog post or read into the 2010 DoJ lawsuit against the Big 5 publishers and Apple around price-fixing. My view is that more than this, publishers have seen the effect of big tech market domination in other sectors, and very much want to avoid a scenario where Amazon controls 80% of their end user sales. The current situation with a diverse range of bookstores (and, in most markets, a diverse range of upstream book printers) is a lot better for publishers and they’ll work on keeping the status quo intact for their own long term benefit.

Endnote

At their core, Lion Rock and Left Field are fairly similar bets on the same industry and management. Personally, I own both with a slant to Lion Rock, which has greater upside from M&A optionality but also greater succession risk. Left Field is great for a more predictable, lower risk/reward style of investing.

NOT INVESTMENT ADVICE

This content is for informational purposes only. You should not construe any information as legal, investment, financial or other advice. Do your own due diligence.

Nielsen BookData

https://www.thebookseller.com/comment/the-profits-from-publishing-a-publishers-perspective

I thought this was a great write-up with a good balance between explaining the business dynamics and capital allocation. A welcome update to our VIC write-up a long time ago!

Just saw this post recently (have not yet come across this stock) and I linked to it in my links post for today: Emerging Market Links + The Week Ahead (June 24, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-june-24-2024