Argent Industrial (ART:JSX)

Underfollowed serial acquirer microcap <5x PE, compounding EPS at 20+%/annum, sensible capital allocation

Executive Summary

Argent Industrial is a South African industrial company. The thesis is fairly simple and can be encapsulated in the following two charts, but I’ll go into a bit more detail about the company in the main article.

Essentially, the company has been repositioning itself away from a legacy South African steel trading and commodity manufacturing business that, in my view, is lucky to clear its cost of capital over a business cycle to a higher margin, specialised niche industrial supplier internationally (primarily in the UK). They have compounded EPS at 31.7%/annum (25% in USD terms) over the past decade; and FCF at 24%, while trading at 5x earnings. Multiples have actually compressed despite the performance!

Business Overview

Argent was founded in 1992 by Teunis Scharrighuisen, who still serves as chairman of the company. His comrade in arms Treve Hendry has been with the company since 1995 and served as CEO since 1997. Here is a list of companies they currently own:

The company has had a small international presence since being listed, but before 2015 it was <5% of revenue. The company was primarily in basic steel commodity manufacturing like XPanda; Jetmaster; Castor and Ladder; Tricks and Toolroom, and had steel trading, automotive parts manufacturing and property holdings. The company has since been utterly transformed, primarily through acquiring international businesses, with some improvements to the South African business as well.

Acquisition Strategy

This is the interesting bit. From the beginning, the company has taken an approach of active M&A and being very decentralised with the acquired companies, reminiscent of a Lifco or CSU. Of the >3000 employees, there are only 4 at the head office. Acquired companies retain their original management and handle operations themselves, with no pressure to force revenue/cost synergies. Specifically, the manufacturing companies are not required to buy from the trading companies to make sure everyone maintains cost discipline. The main change is that all the companies share information on market prices/trends to improve purchasing. Management are very disciplined on cost. They have a target of not paying >6x normalised earnings, but I estimate the historical prices they’ve paid have been below to 4x without using debt, capitalising on distressed sellers after Brexit/Covid.

Head office will very rarely step in to make strategic decisions like selling off most of the property the various companies held to become more asset light in the 2010s, and will occasionally change management if there is a sustained period of underperformance. I expect management to continue moving the focus of the company overseas through acquisitions and dispositions.

Why the internationalisation strategy?

I’m not normally one for diving into politics and macro but for South African investments it seems pretty essential. The ANC, with a solid grip on power since the end of apartheid, has done a terrible job, or as management puts it:

Domestically the consequences of the perfect Fun Show put on by the current elected party has made an absolute mess of the SA markets and is the inspiration to place the company’s operations and production elsewhere in the world.

For those unfamiliar with the state of South Africa, here are a few datapoints:

A common risk factor in South African filings (including Argent) is that ‘the government is unable to supply electricity’. Last year, parts of the country were in rolling blackouts for 78% of the year.1

South Africa has one of the highest rates of violent crime in the world. One of Argent’s largest South African businesses is XPanda, who make these security gates and window bars for people’s homes:

Needless to say, any country where these products are doing a roaring trade is not particularly safe or business-friendly.

The company officially started its strategy of diversifying away from SA in 2017, but unofficially the strategy had been ongoing for a few years before that, likely spurred by this ‘incredibly violent’ strike with hospitalisations, arson and major property damage. NUMSA, the steelworkers union behind this strike and representing many of Argent’s South Africa-based employees, has some rather extreme views, recently calling for a ‘revolutionary agenda’ to ‘nationalise land without compensation’.

This instability should make it clear why Argent has chosen the strategy it has. A positive note is that in June 2024, the ANC lost a majority, and is now in a coalition with the main opposition party (DA). It remains to be seen how things will develop but it seems unlikely the business environment could get much worse.

So what do they actually own overseas?

They own 9 international businesses. A few of these are similar to their South African businesses (Cannock Gates makes iron gates in the UK for example) but the majority are specialised industrial manufacturers.

For example, New Joules Engineering in the US makes piston retarders for railyards, the blue chunks in the image below. (see this BNSF article more about what they do)

Another example is FluidTransfer, which makes aircraft refuelling vehicles:

Essentially they buy a truck, retrofit it to add a fuel storage tank (often provided by FuelProof, another Argent subsidiary), a scissor lift and pumping system, all in line with aviation standards, and get to charge a decent high-teens margin on this.

None of the businesses are ones that’d be up to the standard of a Transdigm or Lifco, but they’re diverse, solidly profitable niches that are unlikely to see a lot of competition and earn a high teens margin. Of note is that management are open to moving away from purely steel businesses. They’ve started leasing out their aviation refuelling trucks ($AHT/$URI anyone?) and are looking to invest more in recurring service-type revenues. In my opinion, it’s important to monitor this small part of the business carefully. If execution is as good as it has been in the heavier industrial manufacturing businesses, margins could continue inflecting upwards rather than approach a high-teens maximum.

Developments in the South African businesses

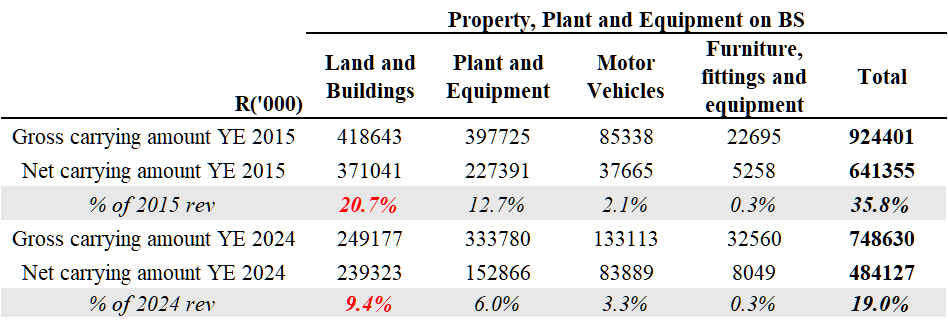

Aside from internalisation, management has improved the operations in South Africa. They’ve fully exited the Automotive business (due to the exit of GM/Toyota from manufacturing in the country), and carried out non-core property sales/sale-leasebacks as shown below.

They’ve downsized the trading operations to about a fifth of the business, but continue running them, largely because no-one wants to buy them (or the other commodity businesses like Megamix which supplies concrete). Frankly they can’t get rid of them soon enough. The segment has been performing relatively well the last few years but I don’t see persistent profitability or any differentiation here, and a full exit could act as a catalyst for rerating.

Capital Allocation and Valuation

Argent is a bit of a share cannibal, having bought back ~40% of shares since 2017, driving much of the EPS CAGR. Broadly speaking, they’ve been fairly good with buybacks, really ramping them up in 2020/21 and adding dividends back into the mix when Covid uncertainty died down.

Since 2022, they’ve adopted a 30% payout ratio policy. I’d love for them to increase this - the balance sheet is a fortress, with ~0 debt and a cash pile ~35% of the market cap, but management has said they’re not changing it. I expect they’re looking to make some large acquisitions with it instead. Going back to the cost discipline, management played down the idea of a tender offer because of the cost, preferring to slowly buyback in the open market despite the limited liquidity and pay out dividends for the remainder of the 30% payout. South Africa has a 20% DWT.

Argent trades at 5.5x earnings and 67% NCAV. Frankly, 5x earnings for a company that can compound bottom line at such a rate and has limited downside from its balance sheet shouldn’t really need a DCF.

Risks

A significant percentage of international earnings growth has come through Rand depreciation. As mentioned, EPS 10Y CAGR drops from 31.7% to ‘only’ 25% in USD terms; while the share price itself obviously became less valuable in USD terms. But going forward as international business continues to grow, the currency effects should become less impactful on the NPV regardless of whether it continues to depreciate or the new government helps it appreciate.

Management has had a great run with acquisitions but acquisitions are always risky, especially if they start moving into non-steel areas that they’re less familiar with.

Catalysts

This is more of a ‘cheap as chips’ idea than one with a firm expiry date, but there are a couple possibilities on the horizon that might help with a rerate.

Relisting to LSE/AIM, more in line with the changing business profile and more accessible to global investors

Possible disposal of low-margin commodity segments to become a purer-play light industrial manufacturing company.

Argent isn’t tradeable on IBKR, but Saxo offers the Johannesburg Stock Exchange.

NOT INVESTMENT ADVICE

This content is for informational purposes only. You should not construe any information as legal, investment, financial or other advice. Do your own due diligence.

https://www.crses.sun.ac.za/downloads/CRSES_Power_Generation_Data_in_South_Africa.pdf

Thank you for the write up, I’m from the UK and it doesn’t look like you can access the company through interactive broker. What broker do you use?

Thank you for the great writeup! Very clear & concise. Looking forward to seeing more from you