10 second take

SF Reit (HK: 2191) is a logistics REIT backed by SF Express (SZSE:2352), China’s biggest courier. The REIT currently yields ~10%, with decent assets, 98% occupancy, and safe future cashflows. The name’s a favourite among Hong Kong investors, with a majority of the people I talk to owning it, but undiscovered internationally due to the ‘Chinese real estate’ vibes.

Business Overview

Background

SF Reit (SFR) was listed in May 2021 as a spinoff of SF Holdings (‘SFH’, SZ:2352, with a rumoured HKEX dual listing), known as the ‘Fedex of China’. In 2023, SFH delivered 12 billion packages, 4 times that of Fedex.1 Interestingly, SF is probably the only logistics provider in China with a real brand. They’re known for being fast, reliable and more premium than their competitors, and merchants on e-commerce platforms will even state they use SF for fulfilment in their product listings as a marketing gimmick.

Like many industries, logistics in China is in a state of oversupply, and has been steadily consolidating. The REIT was listed partially for liquidity to finance the US$2.3bn 51% acquisition of Kerry Logistics (SEHK:636), a major global freight forwarder. Aside from the spun off properties SFH still has ~2000 warehouses across China, comprising >10m sqm GFA. These include cold chain, biotech, airport hubs, interchange and other specialty warehouses. I expect SFH will keep selling assets to SFR over time to free up capital for M&A, debt reduction (73% Debt/Equity) and other expansion.

Portfolio

SF REIT holds 4 warehouses:

160k sqm GFA in Hong Kong

120k sqm GFA in Changsha (tier 2 city in Hunan, pop. 10m)

85k sqm GFA in Foshan (tier 2 city in Guangzhou, pop. 10m, ~1hr drive to Shenzhen)

63k sqm GFA in Wuhu [WOOHOO!] (tier 3 city in Anhui, pop. 3m, ~1hr drive to Nanjing)

Of these, the HK warehouse is by far the most important, representing 3/4ths of net property income. The properties are at 98% occupancy, with ~80% being SFH. The market sits at ~10-20% vacancy - HK on the lower end, and mainland on the higher end. Appraisals seem fairly in line with the market, though the Wuhu warehouse’s cap rate seems a tad low. In a conservative case, if you write the other mainland warehouses all to 0, the implied cap rate for just HK at current market prices is 4.8%. The most recent major transaction similar in profile to their HK warehouse was done in 2022, when GLP acquired an asset from Swire at a 3.33% cap. ESR also announced a new build logistics facility in the area with an expected yield on cost of 4.6%. The most comparable property in terms of location, size and age is owned by Mapletree Logistics, held at a 3.5% cap. There are <20 modern warehouses in HK.2

Valuation

I view SF REIT as a bond proxy with a ~6% credit spread above the 10 year treasury rate at 4.1% and 4.39% SFR is paying, so I’m more concerned about the cashflows than the appraised values (which is probably what the REIT trades on in the short term). and the yield going forward should be fairly safe. SFR pays out 100% of its distributable income (essentially AFFO for those more familiar with western REIT terminology). >70% of their leases expire in 2026. The HK leases should be renewed in line with inflation. Despite the woeful property market in HK, market rents for modern warehouses haven’t actually declined. Cap rates in some transactions have gone up (though to be clear, not near the 4.8% implied cap SFR has), potentially impacting appraised value. Mainland leases are more questionable. If the economy hasn’t improved by then, given the bountiful supply of land and general oversupply, I expect rental reversions to be negative. This should be offset by interest expense declines. SFR’s 33.6% gearing is mostly hedged with interest swaps, but will benefit from US rate cuts by 2025.

The current price seems overly pessimistic in my view. As this is a REIT, there’s no risk of cash hoarding which is the trap most HK property companies trading at a wide discount to NAV fall into. The most reasonable explanation for the current price is that the market expects SFH to exploit SFR shareholders, which we’ll explore now.

Risks

I won’t dwell on Chinese real estate. Plenty of ink has been spilled on the crisis and I won’t pretend to have unique insight. Just know that like other sectors, logistics real estate was overbuilt.

SF Related Party Transactions

Having a captive listed subsidiary that will carry out related party transactions - whether M&A, JVs or other formats is an excellent way to shift risk and returns around the corporate structure to the benefit of the controlling shareholder (and the expense of minorities). Long time investors in Asian conglomerates will no doubt find this familiar. For SFR in particular, the risk is if shareholders are diluted to purchase properties from SFH at inflated prices to fund industry consolidation.

I think the best way to look at this is history. Wang Wei, the founder, chairman, CEO and 53% owner of SFH has historically been good to minority shareholders. SFH started consistently paying dividend at a ~30% payout ratio in 2013, when they started having significant FCF, and they’ve started buybacks in the past few years as multiples have contracted from a lofty 80x to <20x. Capital returns have increased to 50% of NI.

Since IPO, SFR has acquired 1 asset from SFH - Changsha, in June 2022. The acquisition was done at a yield of 6.6%, a slight discount to Changsha logistics transactions at the time (~6%) and a slight premium to the market implied yield of ~7.3% for the other properties. The acquisition was mostly funded with a floating loan, and modelling out the acquisition’s finance costs along the yield curve. it would’ve been marginally accretive to per-share economics. The acquisition seems fair for both SFR and SFH shareholders.

In December 23, SFH announced they were going to spin out another 485k sq.m of mainland Chinese warehouses. SFR (with a right of first refusal) declined to buy them on valuation.

Finally, SFH has also filed for a secondary listing on HKEX to raise US$3bn which will likely happen soon if the current market rally persists.

I think the fact that SFH is looking to raise cash through a secondary listing and another REIT listing, rather than sell properties to SFR at current low market prices, or artifically high ‘appraised’ prices is quite a positive sign for minority shareholders in both SFH and SFR. SFR does seem to be able to make decisions independently.

Hong Kong

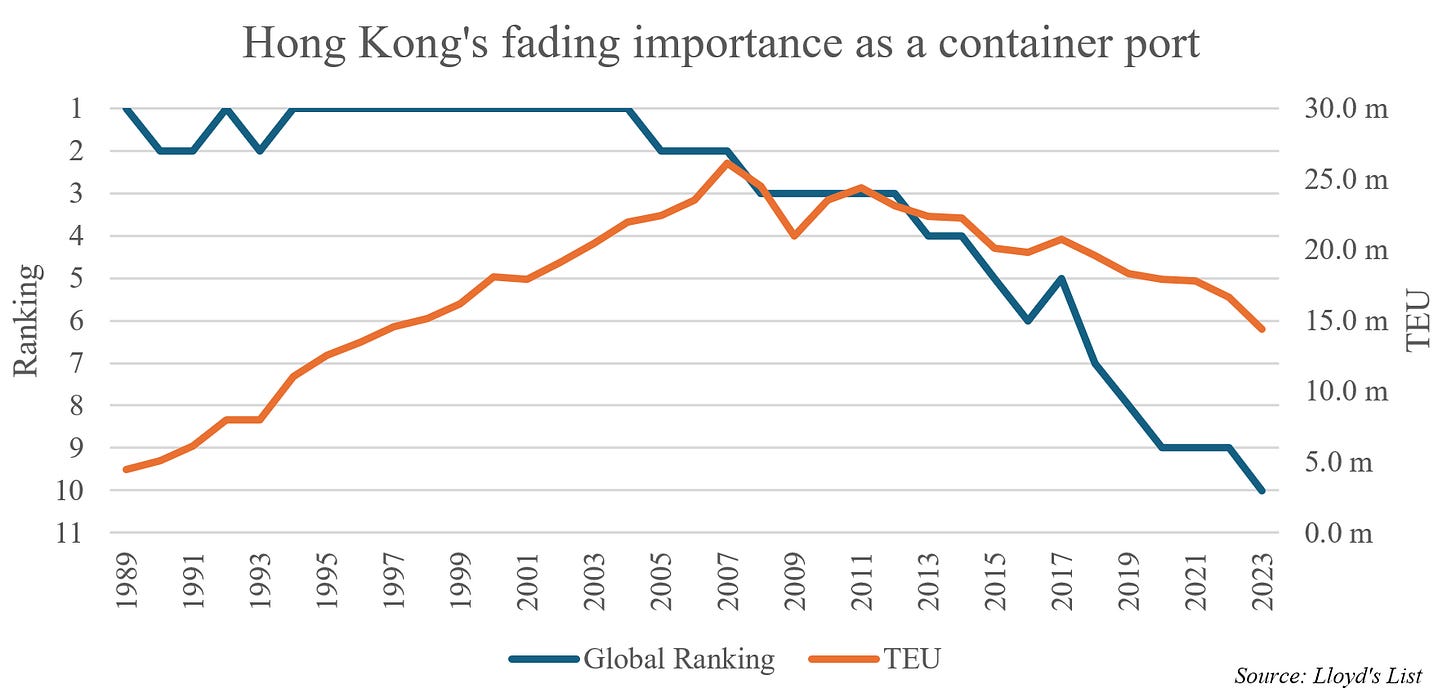

The core of the thesis is the Hong Kong property alone is worth more than the current valuation. However, the importance of Hong Kong as a port has fallen dramatically in recent years and looks like it will continue falling.

Chinese ports have come a long way. Ports like Shanghai Yangshan, Qingdao and Ningbo are the most autonomous in the world, and the government is applying its usual zeal for infrastructure. Hong Kong as a port is more expensive, requires two customs checks for goods entering/exiting the mainland, and now is not even more efficient.

In 2020, as a response to the National Security Law, the US removed Hong Kong’s special trade privileges which used be a tariff loophole.

None of these factors are transitory and I don’t think Hong Kong’s port will recover.

Meanwhile, air cargo has been faring much better, driven in large part by e-commerce platforms like Temu/Shein shipping directly to customers. HKIA has been the busiest cargo airport in the world for a long time and that looks unlikely to change in the near term. Mainland Chinese carriers lag far behind Cathay Pacific in efficiency and specialised cargo airlines like SFH’s own Ezhou cargo airport are still immature.

SFR’s warehouse is located in Tsing Yi, about half an hour’s drive from the airport. New logistics construction has mainly revolved around the airport, with Alibaba-owned Cainiao, YTO Express (SHA: 600233), DHL and UPS all building new assets. The warehouses in Tsing Yi seem to be somewhat stranded, but the silver lining is there isn’t expected to be any new supply in Tsing Yi through 2027.

On balance though, I think the >$10bn HKD cost of building an asset next to the airport isn’t worth it for SFH and that the risk of SFH not renewing the lease is fairly minimal. It’s not an ideal location for HK based logistics going forward but it’s good enough.

Conclusion

I view SFR as a high yielding bond proxy. The dividend is safe, the corporate governance is decent, and the risk of capital loss is minimal. It’s an attractive asset to own, especially if you don’t need to pay dividend tax on it.

Endnote

There’s an important accounting difference between HK/SG listed REITs and those listed in London/NY, in the form of REIT manager fees. Most western REITs self -manage - i.e. expenses go directly on the income statement in G&A. In Asia, REITs are typically managed by a third party controlled by the sponsor. The manager fee can be paid in units or cash, at the manager’s choice - obviously when the the REIT is trading at a NAV discount units are the optimal choice. SFR’s manager fee is 10% of distributable income + a variable fee dependent on per-share income increase, or ~1% of the market cap/year. This is in line with Asian REITs but a fair bit higher than self managed Western ones.

Aside from the problem that the REIT manager fee expense marked at market is understated if you think the units are undervalued, similar to SBC, shareholders also don’t see operating leverage - self-managed REITS’ centralised management costs decline as a % of NAV as NAV grows, but managed REITS pay a fixed % of distributable income + variable fees on top.

NOT INVESTMENT ADVICE

This content is for informational purposes only. You should not construe any information as legal, investment, financial or other advice. Do your own due diligence.

Chinese e-commerce is primarily fulfilled by merchants. A single order with 5 items would result in 5 small packages with AOV <US$2, rather than 1 large package as is common in the West under Fulfilled by Amazon. This increases the industry package volume dramatically.

Modern warehouses have higher ceilings, higher load-bearing floors, larger spacing of columns, direct truck access to all floors, higher electrical supply , better ESG ratings and other features that make it attractive for highly automated use cases. Rents are ~30% higher than traditional warehouses.

Great article. It would be helpful to mention the ticker symbol near the start.

Nice write up. But 10% yield a slight stock price depreciation could be the long term outcome?